What the 2023-24 Tax Brackets and Income-Tax Rates Mean for Your Money: A guide to understanding your federal income-tax rate

Your tax bill is largely determined by tax brackets. These are really just ranges of taxable income. As your taxable income moves up this ladder, each layer gets taxed at progressively higher rates.

How do tax brackets work?

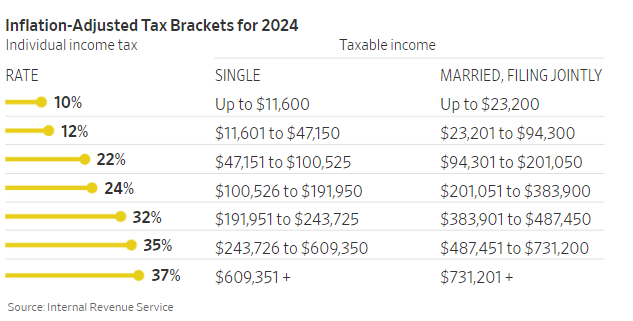

A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. This doesn’t mean all of their income is taxed at that rate. Their effective tax rate would be much lower than that top rate.

That is because the first slice of your taxable income is taxed at 10%, whether you are an entry-level clerk or the chief executive officer. The next slice gets taxed at 12%, and so on. Only the portion of the individual’s taxable income from $100,526 to $191,950 would be taxed at the 24% rate.

Your effective tax rate is essentially a blended rate.

What are the current tax brackets?

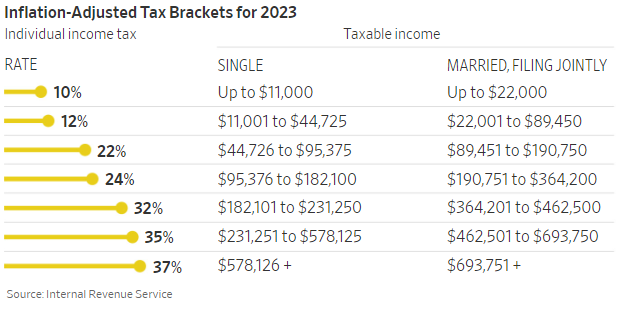

The tax code has seven income-tax brackets for individuals that range from 10% to 37%. The 10% rate takes effect at the first dollar of taxable income, after benefits such as the standard deduction are applied, and each tax rate applies to income in that bracket.

The current rates and brackets were set by the 2017 tax overhaul and expire at the end of 2025. If Congress doesn’t make changes, the top rate will return to 39.6% in 2026.

Are tax brackets adjusted for inflation?

The income-tax brackets are adjusted annually for inflation, although in 2017 Congress switched to an often-slower method of calculating it. At the time, the change was projected to cost Americans $133.5 billion over a decade, according to the congressional Joint Committee on Taxation.

Not all tax provisions are inflation-adjusted, however. Exceptions include the limits for the mortgage-interest deduction, taxes on Social Security benefits, and the 3.8% surtax on net investment income.

The exemption of up to $500,000 on the sale of a home is also unadjusted for inflation, as is the $3,000 deduction of capital losses against ordinary income such as wages.

As a result, millions of Americans owe more tax than they would if these provisions were indexed.

Key 2024 filing season dates

- Jan. 12: IRS Free File opens.

- Jan. 16: Due date for 2023 fourth quarter estimated tax payments.

- Jan. 29: Filing season start date for individual tax returns.

- April 15: Due date to file 2023 tax return or to request an extension for most of the nation.

- April 17: Due date for Maine and Massachusetts.

- Oct. 15: Due date for extension filers.

Source: WSJ