Posts Tagged ‘newyearplanning’

Tips to Navigate Tax Filing Season and the IRS: Be proactive and follow these steps to ensure accuracy and compliance

Tax filing season can be a stressful time for many individuals. Dealing with the IRS and ensuring compliance with tax regulations can seem daunting. However, with proper preparation and a proactive approach, you can navigate the tax filing season with confidence. Here are a few valuable tips to help you effectively deal with the IRS…

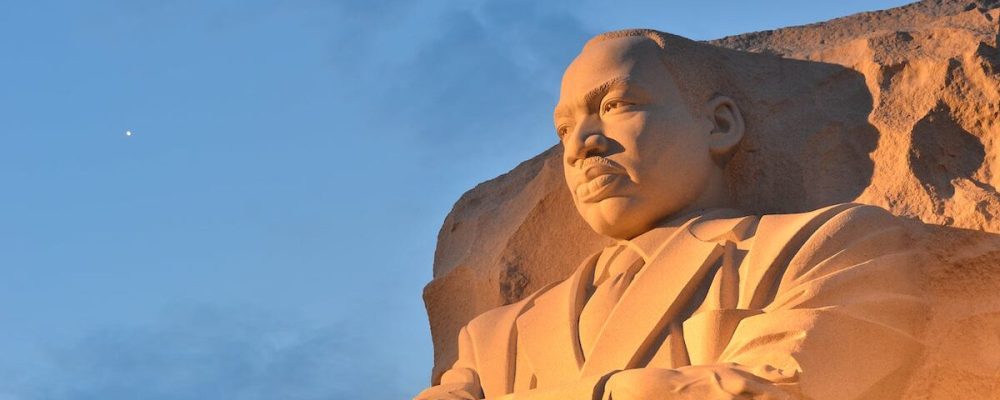

Read More5 money lessons you can learn from Martin Luther King Jr.

Source: Facet Martin Luther King Jr. Day falls on Monday, January 15 this year. It’s more than a day off from work; it’s a vital reminder of our country’s history and how it has shaped us into the nation we are today. This day honors the fact that no matter how much struggle and hardship…

Read MoreHow to Set Achievable Financial Goals for 2024

It’s time to set financial goals that are realistic and attainable. January is an ideal time to lay the groundwork for your financial success in the new year. It’s not just about setting resolutions but also about making practical and straightforward financial decisions. Here’s a guide to help you set achievable financial goals for 2024…

Read MoreA fresh start: 10 money management tips for 2024

As the calendar turns to a new year, it’s time to reflect on our financial habits and set the stage for better money management. Whether you’re looking to build wealth, eliminate debt, or simply gain a better understanding of your finances, the New Year provides a clean slate for financial success. In this article, we…

Read More2023 Tax Guide to Fringe Benefits Released: Cents-per-mile rule, parking and transportation benefits and health FSAs

The IRS has released the 2023 final version of its Publication 15-B (The Employer’s Tax Guide to Fringe Benefits). The “What’s New” section of the publication includes information on the 2023 business mileage rate under the “cents-per-mile rule,” the monthly exclusion for qualified parking and commuter transportation benefits, and the contribution limit on a health flexible…

Read MoreLate January is a Great Time to Pay Your Taxes: Tips for paying taxes soon and what to do if you can’t pay on time

When should you file your income tax? The earlier, the better; before the end of January – if you expect to get a refund. If you file by the end of February, you should receive your check within six weeks. But, if you delay and file in April when the Internal Revenue Service is inundated…

Read MoreTax Filing 2023: How to File Taxes This Year: Here’s how to get started if you’re learning how to file taxes online or on paper.

Tax filing can be daunting. So if you’re wondering how to file taxes in 2023, here’s a cheat sheet on how to do your taxes and how to make tax filing easier. 1. Determine if you need to file Whether you have to file a tax return this year depends on your income, tax filing…

Read MoreKey Financial Data 2023

With three major pieces of tax legislation passed within the last three years, we have more nuances, more inflation adjustments, more expiring tax breaks, and more rules to follow than ever before. Stay on top of the details with our annual compilation of the various tax rates, thresholds, limitations and exemptions for the new year.…

Read MoreSix ways to start fresh financially in 2023

The new year offers an opportunity to reflect on the past and set goals for the future. Revisiting both your personal and financial goals can help set you up for success in 2023 and beyond. Here are six ways to kick off the year with fresh perspective: 1. Revisit your household budget Start the year…

Read More